tax loss harvesting limit

Discover The Answers You Need Here. Ad Make Tax-Smart Investing Part of Your Tax Planning.

How To Use Tax Loss Harvesting To Boost Your Portfolio

Work with Aprio to leverage RD Tax Credits to fund innovation support profitable growth.

. So if you have a 4000 gain and a 1000. Help your clients reduce tax risk while maintaining market exposure. Can You Use Tax-Loss Harvesting to Offset Ordinary Income.

Currently the amount of excess losses you can claim as a deduction is the lesser. Connect With a Fidelity Advisor Today. Limit capital gains for your clients Help your clients offset short-and long-term capital gains with automatic tax-loss harvesting of client accounts.

Ad Over 25 years of offering tax-managed investing solutions to advisors and their clients. Is there a limit to tax-loss harvesting. As mentioned above theres a limit to how much you can reduce your ordinary income each year through tax-loss harvesting.

The taxpayer can take 3000 of that loss as a deduction to reduce other income called ordinary income on the current year tax return. 3000 per year for individual filers or. Is There Any Limit to Tax Loss Harvesting.

The remaining long-term capital loss is. You can harvest as much as you want and offset up to 100 of your. There is no limit on how much loss you can harvest.

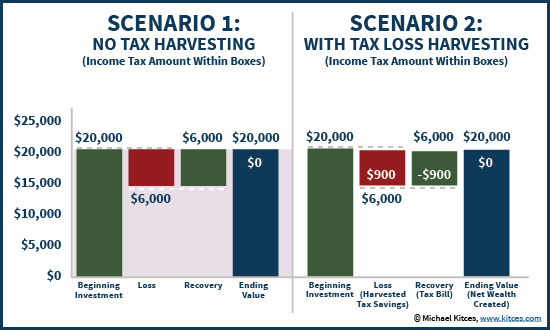

Connect With a Fidelity Advisor Today. Assuming youre subject to a 35 marginal tax rate the overall tax benefit of. There are some rules.

There is no limit to the amount of investment gains that can be offset with tax-loss harvesting. Even if you dont have any capital gains to offset any investment losses in the current tax year could still reduce your taxable income by up to 3000. Help your clients reduce tax risk while maintaining market exposure.

If she deployed the same tax loss harvesting strategy she would have reduced her capital gains tax liability from 300 to 75 a reduction of 60. Whenever total capital gains and losses for the year add up to a negative number a net capital loss is incurred. This illustrates that tax loss.

However there are limits to the amount of taxes on ordinary income that can be. You can still only write off up to 3000 of stock losses so if you exceed that for the following year carry the loss over to subsequent years until you use up your total losses. The leftover 2000 loss could then be carried forward to offset income in future tax years.

Ad Make Tax-Smart Investing Part of Your Tax Planning. Ad Over 25 years of offering tax-managed investing solutions to advisors and their clients. Yes if you have more capital losses in a year than you have capital gains you can use excess capital losses.

If the net capital loss is less than or. Ad Partner with Aprio to claim valuable RD tax credits with confidence. Even if you cant claim the maximum 3000 net loss you can still reduce the value of your gains and save on taxes that way.

Tax-loss harvesting can offer tax benefits but there are limitations on what you can deduct.

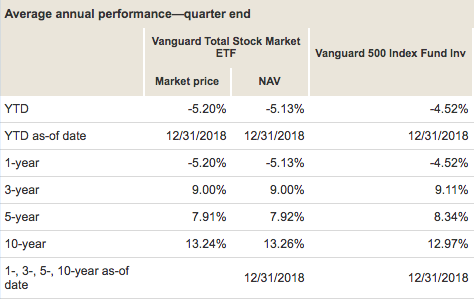

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management

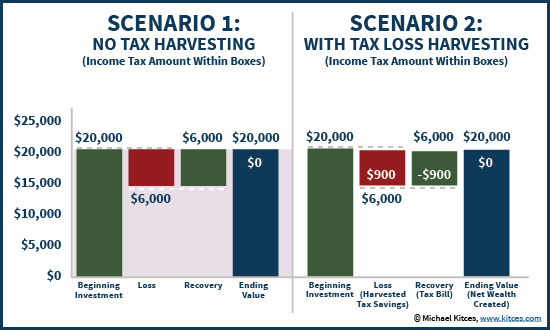

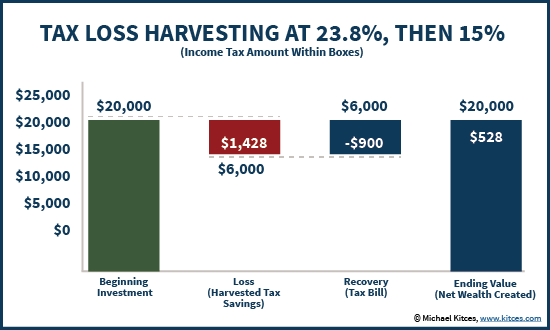

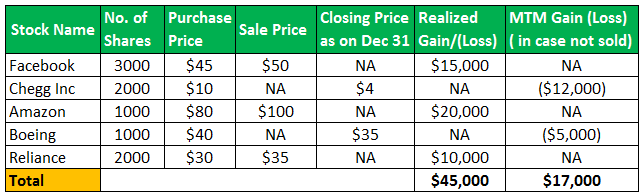

Tax Loss Harvesting Example Of Tax Loss Harvesting How Does It Work

Tax Loss Harvesting Definition Example How It Works

Turning Losses Into Tax Advantages

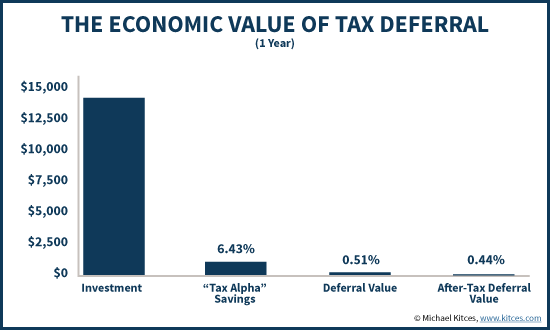

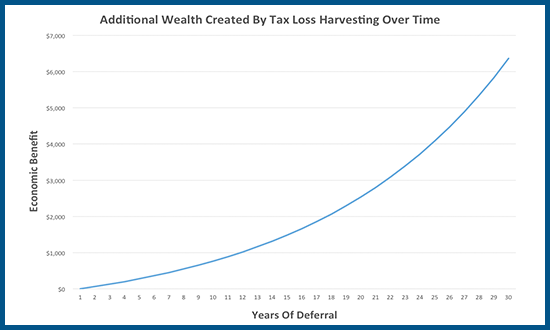

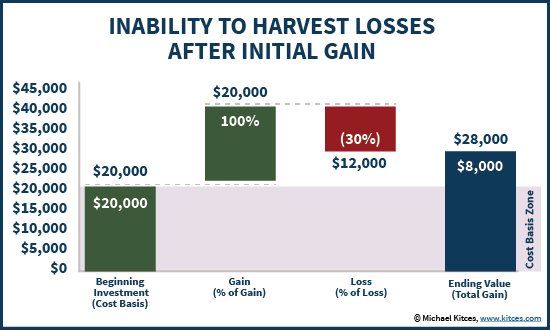

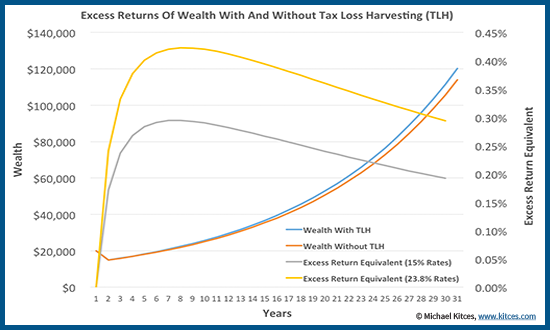

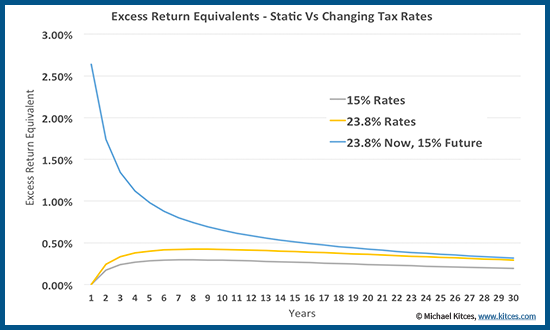

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Reap The Benefits Of Tax Loss Harvesting

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Turning Losses Into Tax Advantages

How To Use Tax Loss Harvesting To Lower Your Taxes Ally

Tax Loss Harvesting Everything You Should Know

Tax Loss Harvesting Definition Example How It Works

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management